December Quarter Overview

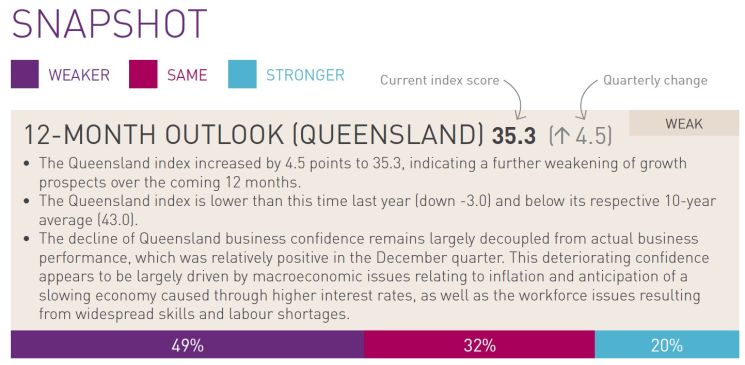

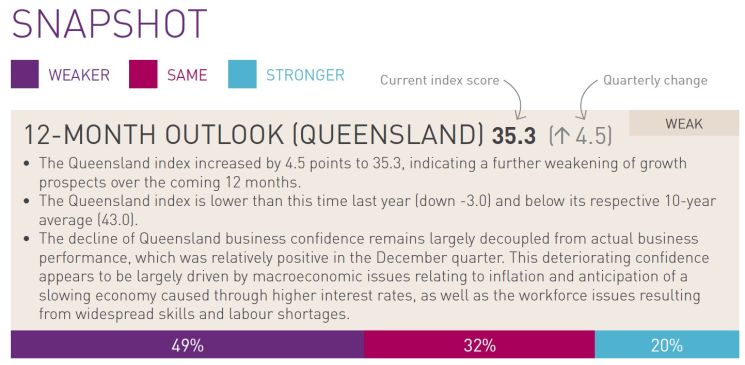

Queensland business confidence remains weak while actual performance holds steady.

Latest results of the December Quarter Pulse Survey indicate a continuation of the unusual situation observed in the previous quarters – weak business confidence as a result of steady business performance being undercut by overwhelming cost pressures. Expectations for the March 2023 quarter predict that these cost pressures are unlikely to ease in the short term.

Latest results of the December Quarter Pulse Survey indicate a continuation of the unusual situation observed in the previous quarters – weak business confidence as a result of steady business performance being undercut by overwhelming cost pressures. Expectations for the March 2023 quarter predict that these cost pressures are unlikely to ease in the short term.

Total sales revenue remained the key positive for the survey results, with 37% of Queensland businesses indicating their sales and revenue improved during the December quarter.

Cost challenges continue to persist and are hindering profitability for many businesses despite solid sales. These issues remain largely unchanged from the previous quarter and are acting as a significant drag on business confidence:

> Rising wage and labour costs

> Rising inflation and cost of goods and services

> Increasing fuel and energy prices

> Supply chain disruptions which are causing stock shortages and delays in both goods and services.

Survey feedback indicates that the lack of confidence is also driven largely by macroeconomic factors that are impacting businesses activities such as:

> Interest rate rises that are anticipated to erode consumer and business spending

> Reduced consumer confidence and emerging fear of a recession

> Staff attraction and retention issues as a result of skill and labour shortages

> Lack of availability of affordable accommodation and rental housing

> Global geopolitical issues such as the war in Ukraine

> Potential natural disasters or other extreme weather events.

A Changing Set of Constraints

Over the past year, there has been a major shake-up in the constraints on business growth. Businesses were asked to what degree to several economic, operational, and workforce factors currently constrain their business growth. Workforce constraints have been overwhelmingly in the lead in recent quarters. Retaining and recruiting suitably qualified employees has ranked first as a key constraint on business growth since March 2022, with an index of 66.2, followed by direct wages costs.

For much of the past decade, the level of demand and economy activity and political and economic stability were the leading key constraints on business. These two constraints have been long-term critical issues, sitting in the top five key constraints for the past 10 years, yet have recently tumbled down the list to seventh and twelfth position respectively.

Excerpt Quotes from businesses

"We are still suffering from the adverse events of Covid 19 plus widespread floods and weather disruptions. The [effect] of movements in the global economy, supply chain issues and ongoing and pending wars is also an issue…"

– Gold Coast Business

"For the last three months, sales have been good due to the Christmas period, but generally overall sales have remained the same as last year. Weather has a lot to do with our business and we have benefitted from that."

– Far North Queensland Business

"Continued shortage of available skilled and interested labour with very low unemployment rates. Competition for skilled labour leads to increased wages that are not sustainable. Along with material price increases over the last year, increasing number of businesses will go into administration hurting more suppliers, sub-contractors and employees."

– Brisbane Business

"Inflation, potential recession, and lower consumer discretionary income. Queensland will suffer for the same

reasons…"

– Central Queensland Business

Download the full report for all the insights by clicking on the link below:

Latest results of the December Quarter Pulse Survey indicate a continuation of the unusual situation observed in the previous quarters – weak business confidence as a result of steady business performance being undercut by overwhelming cost pressures. Expectations for the March 2023 quarter predict that these cost pressures are unlikely to ease in the short term.

Latest results of the December Quarter Pulse Survey indicate a continuation of the unusual situation observed in the previous quarters – weak business confidence as a result of steady business performance being undercut by overwhelming cost pressures. Expectations for the March 2023 quarter predict that these cost pressures are unlikely to ease in the short term.